7 Easy Facts About Paul B Insurance Described

Wiki Article

Some Of Paul B Insurance

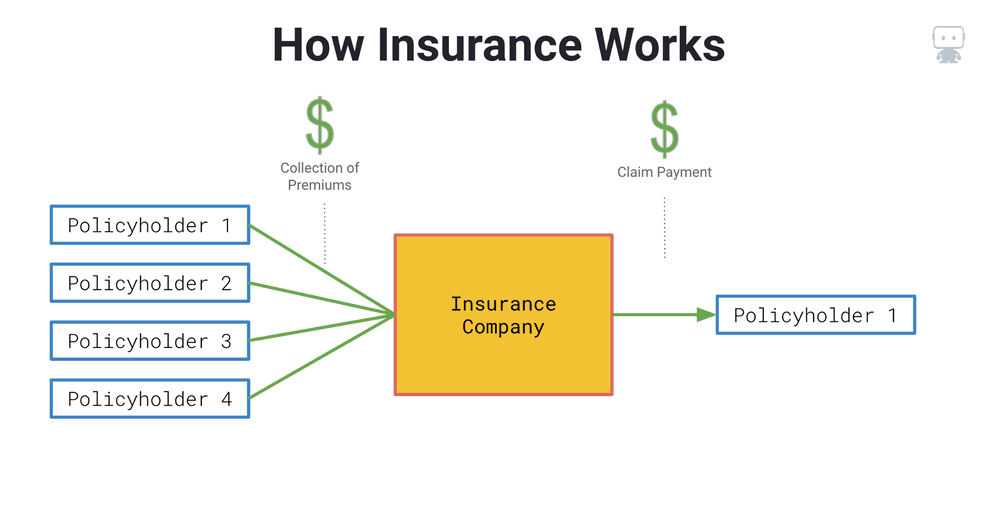

The idea is that the cash paid in insurance claims over time will certainly be much less than the total costs gathered. You may seem like you're tossing cash out the window if you never ever sue, yet having piece of mind that you're covered in case you do experience a considerable loss, can be worth its weight in gold.

Picture you pay $500 a year to guarantee your $200,000 house. You have one decade of making repayments, and you've made no claims. That appears to $500 times 10 years. This indicates you've paid $5,000 for house insurance. You begin to wonder why you are paying a lot for nothing.

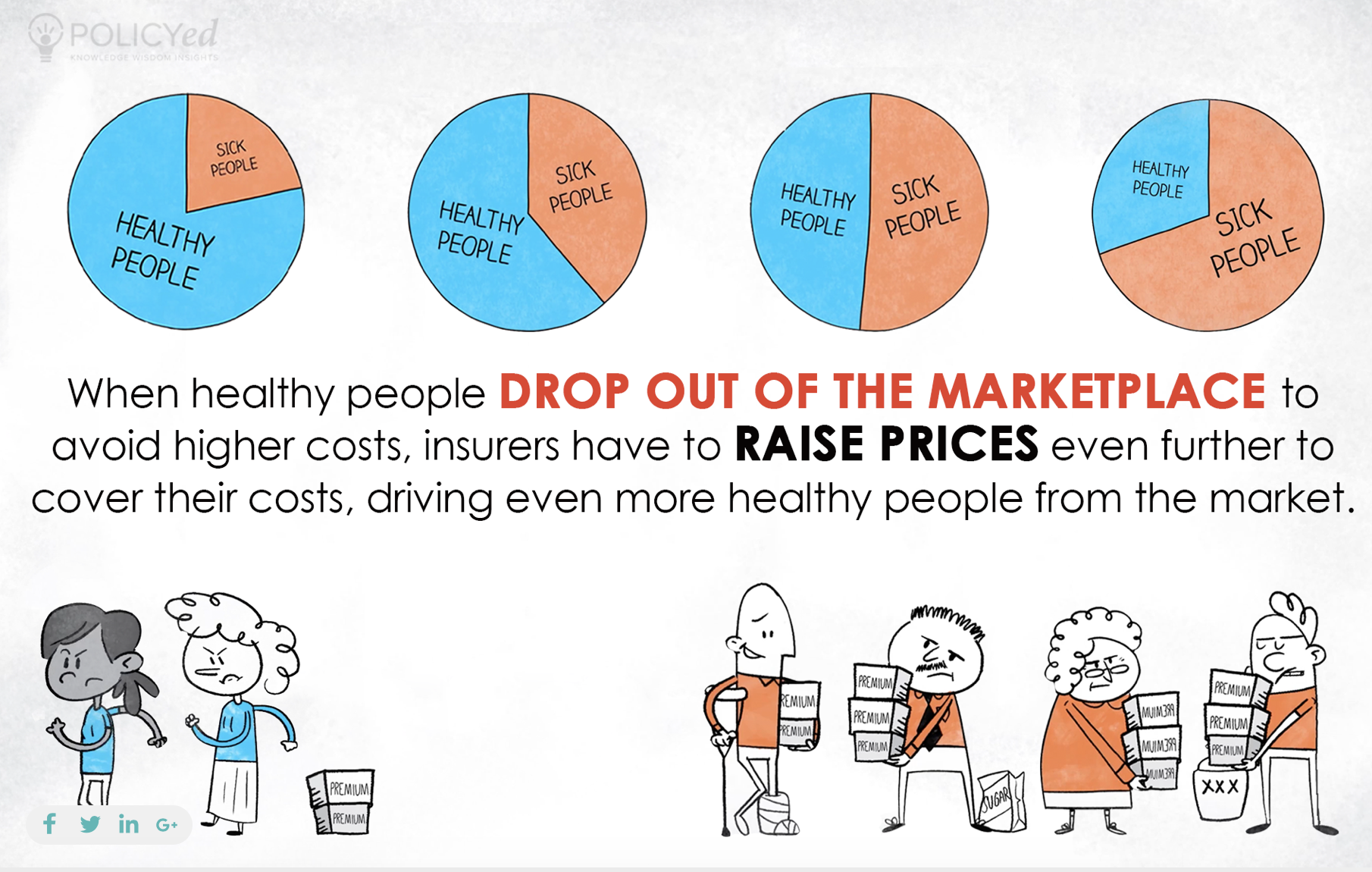

Due to the fact that insurance is based upon spreading out the danger amongst lots of people, it is the pooled money of all individuals spending for it that enables the firm to build possessions and also cover claims when they occur. Insurance policy is a service. It would be great for the firms to simply leave rates at the exact same degree all the time, the fact is that they have to make adequate money to cover all the potential claims their insurance policy holders might make.

Getting The Paul B Insurance To Work

Underwriting modifications and rate increases or declines are based on outcomes the insurance coverage company had in previous years. They market insurance policy from only one company.

The frontline individuals you deal with when you purchase your insurance coverage are the representatives and brokers who stand for the insurance policy company. They an acquainted with that firm's products or offerings, however can not talk in the direction of other business' plans, rates, or product offerings.

Exactly how much threat or loss of cash can you assume on your very own? Do you have the cash to cover your prices or debts if you have an accident? Do you have special demands in your life that require additional protection?

The Only Guide to Paul B Insurance

The insurance policy you require varies based on where you go to in your life, what sort of assets you have, and what your long-term objectives as well as tasks are. That's why it is important to take the time to discuss what you want out of your policy with your representative.

look what i found

If you obtain a lending to buy an automobile, and after that something happens to the car, void insurance policy will pay off any section of your loan that standard vehicle insurance policy doesn't cover. Some lending institutions require their customers to carry void insurance policy.

The primary purpose of life insurance is to give money for your recipients when you die. Depending on the type of plan you have, life insurance can cover: Natural fatalities.

Some Ideas on Paul B Insurance You Should Know

Life insurance policy covers the life of the insured individual. The insurance policy holder, that can be a various person or entity from the insured, pays costs to an insurer. In return, the insurance firm pays out a sum of cash to the recipients listed on the policy. Term life insurance policy covers you for an amount of time selected at acquisition, such as 10, 20 or thirty years.

you could check hereTerm life is prominent since it uses big payments at a reduced expense than long-term life. There are some variants of normal term life insurance coverage policies.

Get the factsPermanent life insurance policy plans develop cash worth as they age. The money value of entire life insurance policy plans grows at a set rate, while the cash worth within universal policies can fluctuate.

Rumored Buzz on Paul B Insurance

If you compare typical life insurance coverage prices, you can see the difference. As an example, $500,000 of whole life protection for a healthy and balanced 30-year-old lady prices around $4,015 annually, on average. That exact same degree of coverage with a 20-year term life plan would cost approximately regarding $188 annually, according to Quotacy, a brokerage company.

Nonetheless, those investments include even more threat. Variable life is another long-term life insurance policy choice. It appears a whole lot like variable global life but is actually different. It's an alternative to whole life with a fixed payout. Insurance holders can make use of financial investment subaccounts to expand the cash money worth of the plan.

Here are some life insurance basics to aid you much better recognize exactly how protection functions. Costs are the repayments you make to the insurance coverage company. For term life policies, these cover the price of your insurance policy as well as administrative costs. With a permanent plan, you'll additionally have the ability to pay money into a cash-value account.

Report this wiki page